Michael Lewis Does It Again

Despite my past readings and general (but basic) understanding that consists of the shady business that occurs on Wall Street, Michael Lewis never fails to uncover some nefarious activity that makes you go, “wut.”

Sometimes it’s mind-boggling, knowing that this just happens on the daily. I mean, what do you expect? If Wall Street traders find a way to take their time, money, and positions of power to potentially make even more money at the expense of the investor, they’re going to do it. But it is interesting to read about what happens when a small few try to stand up and make the playing field equal.

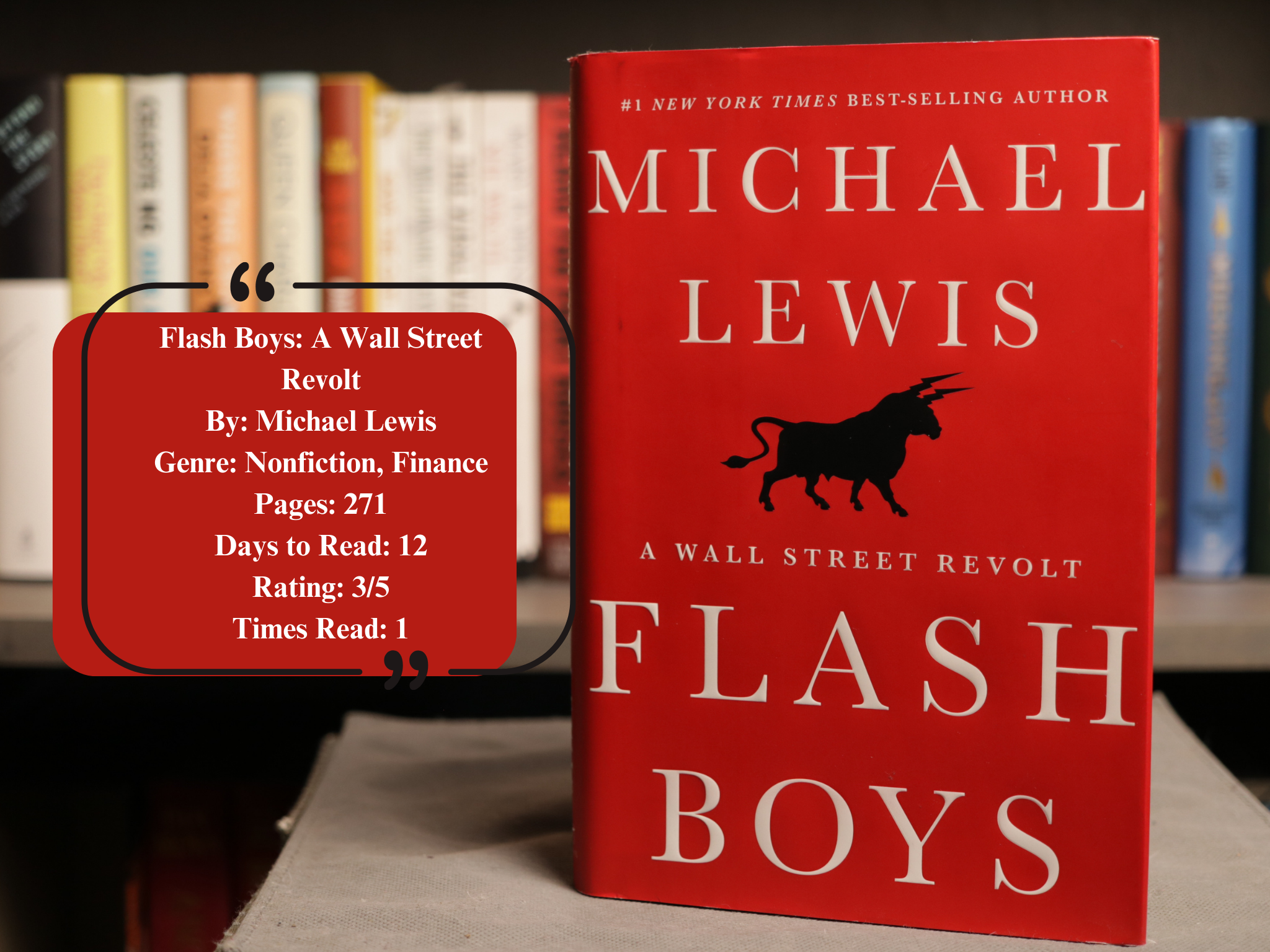

In his book, Flash Boys: A Wall Street Revolt, Michael Lewis talks about the group of men who decided to start their own exchange in an effort to make the stock trade playing field level. Below includes a quick-hit summary of my main takeaways from the book. I also include a more ~eloquent ~ summary (well, as eloquent and I can be, which isn’t much), but really, these are mainly the things I wrote down when I was reading the book as an effort to retain this information longer than the memory of a goldfish. Truly, only time will tell. My hope is to take extensive notes in the future and be able to provide them to you all so that if you didn’t wanna read the book but still wanted to know what happens, you could do just that. Not sure that reading my notes would help you in any way, but hey, it’s an option.

Enough of this, though. Let’s dive into the book notes.

“It was only a matter of time before the stock exchanges figured out that, if people were willing to spend hundreds of thousands of dollars to move their machines around inside some remote data center just so they might be a tiny bit closer to the stock exchange, they’d pay millions to be inside the stock exchange itself”

Pg. 63

TLDR

The Book in Three Sentences

- Banks and financial services companies are making billions of dollars by cutting microseconds off the time it takes for the trade to travel from their desk to the exchange “blackbox.”

- This web of secret exchanges and dark pools created a large, complex system. And most people that work within the industry have no idea how it works.

- Those primarily at RBC found the nefarious behavior to be too grey of an area. So, they decided to create their own exchange to add fairness back into the market.

Who Should Read It

Those that like finance information and the inner workings of how a trade is executed.

How the Book Changed Me

It mostly gave me a clearer idea of how dark pool trading works. For those that are high frequency traders, this information is crucial to know and understand, otherwise, it can be tough to do your job.

Top Three Quotes

- Dark Pools – Private stock exchanges, run by big brokers, they were not required to reveal to the public what happened inside them (pg. 42).

- “Someone out there was using the fact that stock market orders arrived at different times at different exchanges to front-run orders from one market to another” (pg. 50).

- “That’s why volatility was so valuable to high-frequency traders: It created new prices for fast traders to see first and to exploit” (pg. 98).

What’s Wall Street Up to This Time?

It all started with this desire to cut time. When a trade is placed and submitted, it takes time for that information to travel from the trade desk to the mysterious black box that actually documents the trade and dictates what time and price the trade was executed.

This time it takes to travel, time measured in microseconds, gives high frequency traders the leg up on trades. If they see someone is looking to buy X shares of a company, they actually have the means to front-run them at a lower price. These trades are usually in large volumes, too, so while it may seem like they’re making pennies on a trade, it all adds up.

To billions of dollars.

Chump change amirite?

And while there was (is?) technically nothing illegal about this, it doesn’t mean it’s right. HFT’s profited of their ability to place trades faster and to live in a world of complex and convoluted information. Ring to decipher the information would only lead you further down the rabbit hole of questionable Wall Street activities. Sort of like pulling a loose thread on your sweater, and the more you pull, the more the sweater becomes unraveled.

Brad, Ronin, and IEX

A few ended up doing this, or tried to. Brad Katsuyama and some of his team members at RBC went into the trenches to find out the what and the why. It started off as a question of “Why am I seeing my submitted trades with prices that aren’t matching what I see on the computer screen?” And then it turned into “What can I create to ensure that when I place my trades, they’ll all be recorded at the exchanges at the same time?”

Him and his team figured out how to do it, and even received offers to sell the idea for a great deal of money. But Brad thought they could do better.

He thought he could make an exchange that created equality amongst the trades. A level playing field.

So, he left his cushy job at RBC, his team members followed suit, and they created IEX, an exchange that tried to cut out all the legal loopholes to make sure those that traded on it would have a fair chance. It was tough work, getting IEX off the ground. It required a lot of investors to help them operate from the start. They also enlisted the help of the Puzzle Masters, a group of individuals who made sure that their exchange didn’t look like a tangled web of confusion like most exchanges (typically, trading platforms and exchanges were built off of the old platforms in place, so upgrades were added onto an already confusing system. To fix things when they broke, it was like trying to find the broken rubber band in a rubber band ball and then fixing that particular rubber band). And then, they needed someone to manage the exchange, to make sure trades were placed correctly and if there were any fires that needed to be put out that they were done in a timely manner.

All of this was done so that they could prove one thing. “They needed to be able to prove to investors that an explicitly fair exchange yielded better outcomes for investors than all the other exchanges” (190).

Before they launched their exchange, Brad and the team at IEX determined that they would need to trade 5,000,000 times a day in order to be profitable and stay afloat. It took a few months, but in December, they were finally able to reach this goal thanks to some trades that were brought through by some Goldman people.

But What About Sergei?

Sergei Aleynikov was a Russian immigrant that spent most of his life learning about computers and programming. When he moved to the states, he wrote programming for a communications company and did very well for himself there. Eventually, he changed jobs and began to work for Goldman as a programmer, and this was vastly different than what he did at his old firm. Not in the sense that programming was different, but that the system itself was a tangled mess of code that had no end in sight. If issues came up, Sergei wasn’t tasked with finding the root cause, his objective was to create patches, a bandaid of code so to speak, to fix the issue so they could be up and running as quickly as possible. Nothing about this way of working felt efficient to Sergei, but because of his skills, he found himself to be a valuable employee for Goldman. Sergei never felt animosity toward his job, but as time went on, there were other job opportunities that came up, and when one piqued his interest, he decided to put in his two weeks.

Well, in his case, it was more like six weeks to help train his replacement.

During this time, Sergei wanted to take some code with him, all open-sourced and mostly just notes on how he solved certain problems. Every so often, he copied the code and sent it to himself so that he could have generic references at his new job.

Unfortunately for Sergei, the manner in which he did this (which is how he’d normally done it over the course of his career at Goldman) appeared suspicious, and since there were tiny edits to the code on Goldman’s network, Goldman claimed that Sergei was stealing proprietary code and called the FBI.

He was prosecuted and later acquitted, but the grounds in which he was arrested and tried were rather ridiculous. But, it just goes to show that you have to be cognizant of what you do on your work computer because them big banks will stop at nothing to protect what’s “theirs” (lmao someone should send them the definition of “open source”).

What Does This All Mean?

For my situation in particular, I felt that really this book was for educational purposes. I’m not a high frequency trader nor do I plan to try and day trade in my free time, so learning about how big banks are making millions, even billions, off their ability to spend unlimited resources to cut trade times down is mostly eye-opening. Seeing Goldman as a big name in this is not really a shocker to me at this point, either. But, I would be curious to see how the playing field is today. This book was originally written back in 2014, and it would be naive of me to think that change and people’s ability to make trade times even faster was impossible.

It was interesting to hear more about Brad and his team at IEX, and now I’m curious to read about them some more. Again, I’m sure lots of changes have occurred with that firm since 2014.

As a casual reader, my main takeaway of this book is that when microseconds can be cut to make more money, companies will do it. Simple as that.

TLDR Rating: 3/5 stars! Solid read for me, though tough to follow at times. Hard to recommend to everyone.

When it comes to rating this book, I found myself drifting a bit. I wasn’t fully captivated by the story, probably because it was so complex and convoluted that I struggled to keep up. Lewis’s books never fail to make my eyes widen in shock factor, but I feel that out of his other books that I’ve read so far, this one wasn’t my favorite.

Would I recommend this to a friend? Yes, but with an asterisk. I’d think about what their interests and whether or not they’re familiar with certain stock market terms and if it’s an area that interests them. It just might not be their cup of tea, and for that reason, this book wouldn’t be at the top of my list to say “you need to read this ASAP.”

I’m also trying to be a tad more critical with my ratings. I only rate in whole stars, and since this book didn’t keep me up at night thinking about how HFTs are taking advantage of the average daily trader, this was a good read and I do think I learned something. A very solid, strong 3 star rating for me.

How Many Microseconds Does it Take to Like and Follow?

Welp, that’s all she wrote! Might’ve forgotten something or completely missed Mike’s memo on what this book is about, but let’s just say that my nonfiction book notes are a work in progress… But! That means there’s always an opportunity to learn and grow from this experience, and I’m glad that Flash Boys was a book that I was able to dive into and capture some more notes than I normally do.

If you enjoyed this, please support this post or page by giving a like and follow! I’m also on YouTube if somehow you made it to the end of the post and decided that the written word just isn’t for you.

Below are the links!

Thanks so much for reading this, and I hope you all have a great day! Till next time. 🫰

JEMY

Leave a Reply